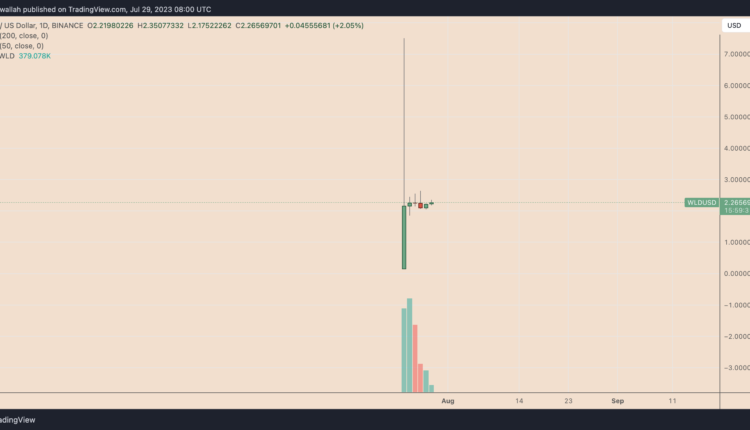

The price of Worldcoin (WLD) has stabilized after a volatile debut across mainstream cryptocurrency exchanges.

On July 29, the WLD price rose nearly 6% to $2.35. Still, the token was down 70% from its market debut peak of $7.50.

It now appears stuck inside the $2–2.50 trading range, hinting at a growing bias conflict in the market.

WLD could stick around $2 until October

Notably, WLD is a part of the Worldcoin Foundation launched by OpenAI’s Sam Altman on July 24.

The token has a maximum circulation supply of 143 million, with 43 million going to Worldcoin’s app users via airdrop — 25 WLD per user — if they verify their identity using an eye-scanning physical orb.

The remaining 100 million tokens have been loaned to market makers outside the U.S. until October 2023. These market makers can return the WLD tokens or buy them for $2 + ($0.04 * X) — where X is the number of tokens being purchased divided by 1 million.

As a result, WLD price appears to be anchored around the $2 level, which, according to Kaiko Research, could be Worldcoin’s strategy to keep the token attractive for potential users.

“Convincing people to scan their eyes for 25 units of a token that doesn’t yet exist can be challenging; if the token’s price is, say, $0.10, it’s even more challenging,” the data analysis firm said in its latest report, adding:

“The 25 WLD tokens are currently worth a little more than $50 and will likely stay in that range for the next three months. So far, this seems to be enticing people to sign up and scan.”

Worldcoin price technical analysis

The total number of Optimism wallets holding WLD tokens have jumped to nearly 305,000 since July 24, according to Dune Analytics.

Meanwhile, the WLD transfer volume has dropped in the same timeframe. These metrics show that most traders have preferred to hold the token.

As a newly launched token, WLD lacks enough trading history to conduct a long-term price analysis. However, on a shorter-timeframe chart, the Worldcoin token appears to be fluctuating inside an ascending channel pattern.

As of June 29, the price traded near the channel’s lower trendline while eyeing a rebound toward the $2.35-2.40 range (marked as “resistance 1” in the chart above), which coincides with the upper trendline.

Related: Worldcoin is making reality look like a lot like Black Mirror

A close above the upper trendline may increase WLD’s prospects of rallying further toward the $2.50-2.56 range (resistance 2) in Q3, up around 12% from current price levels.

On the other hand, breaking below the lower trendline could bring the WLD price inside the $2.15-2.20 range (support 1). A close below the lower trendline range could have the price test the $2-2.10 range as its next downside target, down approximately 10% from current price levels.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.