A report from crypto firm Paxos has revealed that 99% of the U.S. financial services companies it surveyed put as much or more focus on crypto projects this year than in previous years.

Paxos surveyed 400 executives from United States-based financial services companies with at least five million users and $50 billion in assets under management or $50 billion annual payments volume.

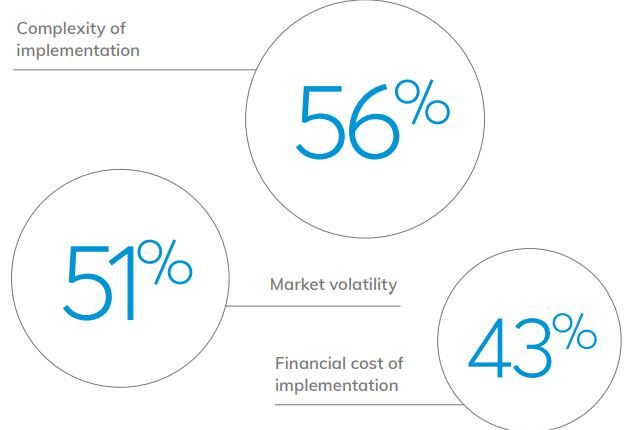

The “2023 Enterprise Digital Asset Adoption Report” shows that despite this overwhelming interest in adopting the technology, the companies are facing various barriers and challenges. 56% of those surveyed said implementation complexity is the largest impediment to launching a crypto solution. Paxos said:

“The resilience of digital assets and blockchain technology in the face of market events, economic challenges, and a need for more regulatory clarity reflects that companies have internalized the value of the technology in the long term.”

Commenting on the difficulties in crypto infrastructure, Mastercard executive Jonathan Anastasia said in the report that working with a crypto-native firm helped them. “Infrastructure is hard. We needed to look for a native player in this space with that deep expertise to bring the companies together on that journey.”

Related: JPMorgan, Apollo plan for enterprise mainnet, execs reveal

The report goes on to say that 51% of the respondents cited market volatility as a major hurdle to their company moving forward with crypto or blockchain projects, and another 43% cited the financial cost of implementation as a significant roadblock.

Despite the challenges, fewer than 2% of the survey respondents said a lack of belief in blockchain’s benefits was an impediment.

Magazine: Lawmakers’ fear and doubt drives proposed crypto regulations in US