Opinion by: Billy Sebell, executive director at XDC Foundation

In just over a decade, blockchain technology has rewritten the rulebook for global finance, bringing transparency, speed and access to financial markets. It has clearly established its worth in digital assets, decentralized finance (DeFi) and cross-border payments, among other effective use cases.

Perhaps the greatest unrealized potential for blockchain lies in one of the world’s most vital sectors: global trade finance.

Trade finance, the capital and credit that enable goods and services to move across borders, forms the backbone of the global economy. It’s a $9.7-trillion market yet remains highly inefficient, paper-based and largely inaccessible to small- and medium-sized enterprises (SMEs).

This combination of size, importance and friction makes trade finance the largest real-world opportunity for blockchain, creating the potential to solve inefficiencies while opening entirely new markets for investors and institutions alike.

The scale and the gap

Despite being one of the world’s oldest financial systems, trade finance has seen limited modernization. Nearly 90% of global trade value relies on financing mechanisms like letters of credit, bills of lading and invoice factoring. As a result, an estimated $2.5-trillion global trade finance gap affects countless businesses, mostly SMEs, which cannot access the credit they need to grow.

When small manufacturers or exporters can’t secure trade credit, they can lose contracts and face slower production. The result is fewer jobs, limited supply chains and reduced economic inclusion. Solving this financing gap could spur enormous economic growth. Blockchain is the first technology fully capable of accomplishing what has previously been out of reach.

Trade finance and blockchain are a perfect match

The trade finance sector is plagued by inefficiency and fraud. Each shipment of goods can involve 10 or more parties, including banks, insurers, shippers and customs agents. Reams of paper documents must be reconciled and verified manually, with these analog processes often responsible for delays, errors and duplication.

Blockchain can provide solutions to these pain points directly by replacing manual, paper-based processes with digital, tamper-proof workflows. As trade documents, including invoices, purchase orders and bills of lading, are recorded onchain, parties across the supply chain can verify the authenticity of a document without relying on intermediaries, thereby reducing fraud and costly delays. This level of digitization is particularly valuable in cross-border trade, where inconsistent standards and fragmented systems can slow commerce.

Tokenization builds on this foundation by converting trade assets, such as receivables, into digital assets that can be easily transferred and settled instantly. And instead of being locked in local markets or bank portfolios, these assets become accessible to a global pool of investors. For exporters and partners, the result is deeper liquidity and greater access to capital. For SMEs in emerging economies, this offers a new path to financing, as tokenized trade assets provide a bridge between real-world economic activity and global digital markets. This enables capital to flow where it’s most needed.

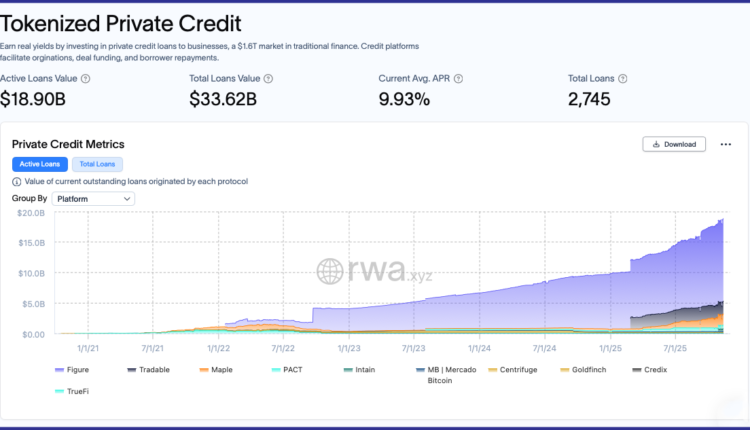

As numerous asset classes have already gone digital, it appears that trade finance is likely the next sector to follow suit. Tokenized US Treasurys, bonds and funds have grown into the tens of billions of dollars. It is estimated that private credit will comprise $1.6 trillion in tokenized assets, where trade finance is a $9-trillion industry, highlighting a clear opportunity for this sector. This imbalance highlights a unique position: The next wave of tokenization will be driven by real-world assets that fund real economic activity.

Riding the policy tailwind

One of the biggest historical obstacles to trade finance modernization has been legal uncertainty. If trade instruments weren’t recognized in digital form, tokenizing them carried little enforceable value. Today, that barrier is quickly disappearing.

Recent developments have created an unprecedented policy tailwind for digital trade, finally granting electronic documents a clear legal standing. The UN’s Model Law on Electronic Transferable Records (MLETR) established a global framework for defining how digital trade instruments are recognized and enforced across jurisdictions. The UK advanced this further with its 2023 Electronic Trade Documents Act, giving full legal equivalence to digital records.

Most recently in the US, the 2025 GENIUS Act established federal standards for stablecoins, including 100% reserve requirements, creating a regulated foundation for blockchain settlement. This clarity not only protects investors but also enables regulated stablecoins to be used compliantly in settlement flows for trade transactions.

Together, these developments have enabled trade documents to move onchain with legal certainty and allow compliant digital dollars to be used in global settlement — a combination that finally makes large-scale, tokenized trade finance viable.

Trade finance to the fore

We’ve already seen how tokenization can successfully bring traditional assets onchain. The growing interest in stablecoins like USDC (USDC) demonstrates that a digital representation of real-world money can achieve mass adoption, and this interest is expected to increase further due to recent regulatory guidance. This same principle now applies to trade finance assets.

Related: How US banks are quietly preparing for an onchain future

As evidence, the broader tokenization market has expanded from under $1 billion just a few years ago to nearly $30 billion today, with some forecasts exceeding $16 trillion by 2030. Yet trade finance remains a mere fraction of that total. The technology, regulation and institutional appetite have all matured. Trade finance now needs a scalable, proven, immutable and compliant model for real-world deployment.

That convergence is now beginning to take shape. Digitization initiatives by ports, customs agencies and multinational banks are creating the digital inputs needed for tokenization. Regulators are clarifying standards. And institutional DeFi platforms are emerging to connect real-world credit with onchain liquidity.

A once-in-a-generation opportunity

Trade finance may not generate the hype of tokenized treasuries, but its potential for real-world influence is even greater. It sits at the intersection of finance, technology and global commerce, which is an area where blockchain’s strengths directly address and correct structural weaknesses in traditional systems.

As regulatory clarity continues to take shape and digital infrastructure matures, tokenized trade finance can evolve from pilot projects into a mainstream financial market. By opening this $9-trillion sector to new participants, blockchain won’t just make global trade more efficient; it will also make it more inclusive, resilient and transparent.

The question is no longer whether blockchain will transform trade finance. The question is how fast we can seize the opportunity to bring this critical industry sector fully into the digital economy.

Opinion by: Billy Sebell, executive director at XDC Foundation.

This opinion article presents the contributor’s expert view and it may not reflect the views of Cointelegraph.com. This content has undergone editorial review to ensure clarity and relevance, Cointelegraph remains committed to transparent reporting and upholding the highest standards of journalism. Readers are encouraged to conduct their own research before taking any actions related to the company.

This opinion article presents the contributor’s expert view and it may not reflect the views of Cointelegraph.com. This content has undergone editorial review to ensure clarity and relevance, Cointelegraph remains committed to transparent reporting and upholding the highest standards of journalism. Readers are encouraged to conduct their own research before taking any actions related to the company.