Protocol to identify ‘systemically important’ blockchain banks could help prevent a market crash: Study

Kanis Saengchote, a researcher at Chulalongkorn University in Thailand, recently developed a framework for identifying and measuring systemic risk in decentralized finance (DeFi) institutions.

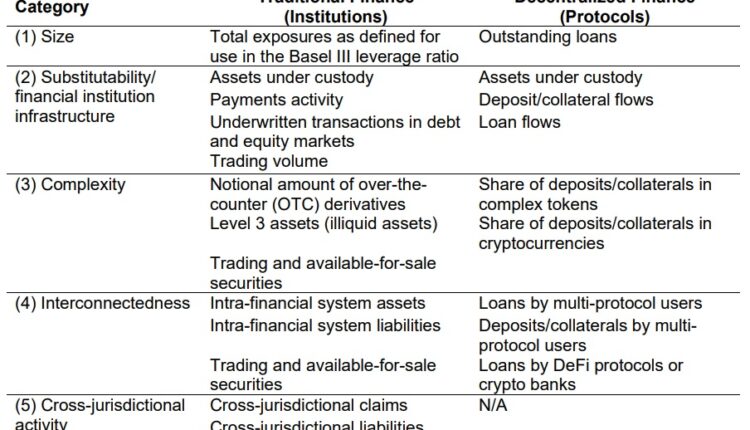

The new protocol is called the Global Systematically Important Protocol (G-SIP), and it’s based on a similar endeavor instituted in the traditional banking industry.

After the global banking crisis of 2008, the traditional finance sector collaborated to come up with a protocol for identifying critical banking structures in order to implement strategies for the prevention of future collapses.

Related: UBS Group agrees to $3.25B ‘emergency rescue’ of Credit Suisse

What they came up with is a system to identify and measure “global systemically important banks” (G-SIBs). This allowed the Bank for International Settlements to identify weaknesses and establish standards resulting in better protection against losses.

Saengchote’s research paper details a method by which a similar standard could be applied to what the paper refers to as “blockchain banks,” essentially any DeFi protocol running on a blockchain.

Per the research paper:

“Identifying systemic risk and creating contingencies to handle emergencies are important because of the self-reinforcing nature of financial interactions and fire sale-induced deleveraging.”

Due to the algorithmic nature of DeFi, deleveraging can occur relatively quickly. This was evident in the Terra collapse. According to Saengchote, this can create a destabilizing loop that sends protocols into a “death spiral.”

The resulting fire sale — a period where asset holders across multiple institutions sell en masse for below market value — could cause rippling illiquidity throughout the connected ecosystem.

G-SIP measures how the various DeFi protocols interact and identifies which nodes in the network have outsized influence. To define the protocol’s parameters, Saengchote studied four separate protocols representing 88% of the “blockchain banks” on the Ethereum blockchain (Aave, Compound, Liquity and MakerDAO).

Upon analysis, MakerDAO scored the highest across the G-SIP categories. According to Saengchote, this is “due to its complexity and interconnectedness.” MakerDAO received a score of 37 on the G-SIP rating scale. It was followed by Aave (31.56), Compound (28) and Liquity (4.57).

The researcher notes, “Because of its small size, Liquity’s score is the lowest among all categories. Nevertheless, as of July 2023, it is the 14th largest protocol in Ethereum.”

In context, this means that MakerDAO has a potentially higher risk profile than the three other protocols and would thus have higher capital requirements to properly mitigate those risks.

Collect this article as an NFT to preserve this moment in history and show your support for independent journalism in the crypto space.