The Ether price has held above $1,820 for the past three weeks, despite facing a 13.7% correction between April 18-21. Still, analyzing a broader time frame provides a more constructive view, as Ether (ETH) has gained 20.8% in three months while the S&P 500 stock market index has stood flat. However, according to ETH options and futures metrics, the gains have not been enough to make professional investors bullish.

Worsening macroeconomic conditions have driven cryptocurrencies’ positive momentum in 2023, including the ongoing banking crisis. According to Arthur Hayes, former CEO of crypto derivatives exchange BitMEX, if the government refuses to bail out First Republic Bank, it could set off a dangerous chain reaction of insolvencies.

Recession risks increased after the United States economy grew at a modest 1.1% annualized pace in the first quarter, well below the 2% expected. Meanwhile, inflation continues to hurt the economy, as the personal consumption expenditures price index rose 4.2% in the first quarter.

Driving the bearishness from whales and market makers is the diminishing total value locked (TVL) and average transaction fees above $4 since February on the Ethereum network. According to DefiLlama data, Ethereum decentralized applications reached 15.3 million ETH in TVL on April 24. That compares with 22.0 million ETH six months prior, a 30% decline.

Ether’s inability to break above $2,000 could also reflect traders anticipating the Federal Reserve raising interest rates again on May 3. Higher interest rates make fixed-income investments more attractive, while businesses and families face additional costs to refinance their debts, creating a bearish environment for risk assets, including ETH.

Ether futures show lack of buying appetite

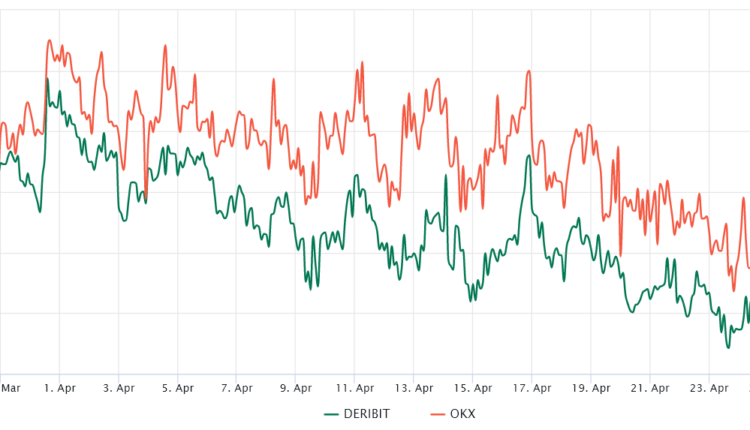

Ether quarterly futures are popular among whales and arbitrage desks. However, these fixed-month contracts typically trade at a slight premium to spot markets, indicating that sellers are asking for more money to delay settlement.

As a result, futures contracts in healthy markets should trade at a 5% to 10% annualized premium — a situation known as contango, which is not unique to crypto markets.

Ether traders have been cautious in the past few weeks, and even with the recent breakout above $2,100 on April 14, there has been no surge in demand for leveraged longs.

Furthermore, the Ether futures premium has worsened from its recent peak of 4.7% on April 1 to its current 1.8% level. This suggests that buyers are avoiding leveraged longs and there is a moderate demand for short (bear) positions using futures contracts.

Ether options traders flirted with bearishness

Traders should also analyze options markets to understand whether the recent correction has caused investors to become more optimistic. The 25% delta skew is a telling sign when arbitrage desks and market makers overcharge for upside or downside protection.

In short, if traders anticipate an Ether price drop, the skew metric will rise above 7%, and phases of excitement tend to have a negative 7% skew.

Related: 11 industry leaders discuss effective ways to ensure compliant staking

Currently, the options delta 25% skew is neutral between protective puts and neutral-to-bullish call options. However, between April 24-26, the indicator briefly sustained levels above 7%, as traders feared a sharp price correction was the most likely scenario.

This change indicates a slight increase in confidence, but over the past four weeks, moderate fear has been the prevailing sentiment, according to the 25% options skew.

In essence, Ether options and futures markets suggest that pro traders are less confident than a week prior but not excessively pessimistic. Consequently, if the ETH price breaks above $2,000, it would be a surprise for most, but at the same time, the indicators show no signs of stress.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.