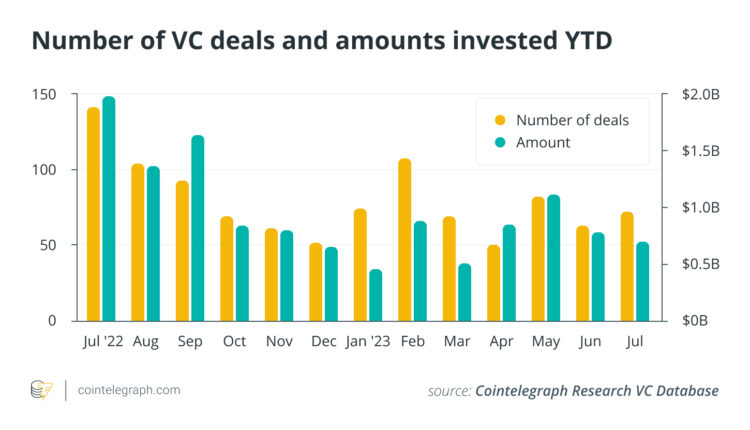

July saw a drop in capital inflows from venture capitalists by 10.26% resulting in $700 million raised according to Cointelegraph Research VC Database. The last two months rejected the potential upward trend, as it seems that macroeconomic conditions revolving around the United States Federal Reserve rate hikes and geopolitical events are still having a more severe impact on VCs’ decision making.

With this in mind, many firms are staying risk-off with most of their reserves, while some are deploying portions of capital to value investments. Generally, VCs are closely examining each new project for potential investment opportunities, preferring to follow smart money instead of taking stabs in the dark.

Purchase access to the Cointelegraph Research VC Database.

However, not everything is so grim in the crypto VC sector. Polychain Capital launched an Investment Fund IV for $200 million, and CoinFund launched a Seed Fund IV for $152 million in July. Under current conditions, they can be considered notable outliers. For comparison, June only saw three crypto funds emerge, raising less than $100 million in total.

The hype around the potential approval of spot Bitcoin (BTC) exchange-traded funds (ETFs) in the U.S. is also heating up, and if one can receive approval from the SEC, it could revitalize the industry and drive the next crypto bull run. The approval will likely send an inspiring signal for crypto VCs and bring more attention and capital into the industry. Though, we are yet to see whether this will turn the investment trend upside down.

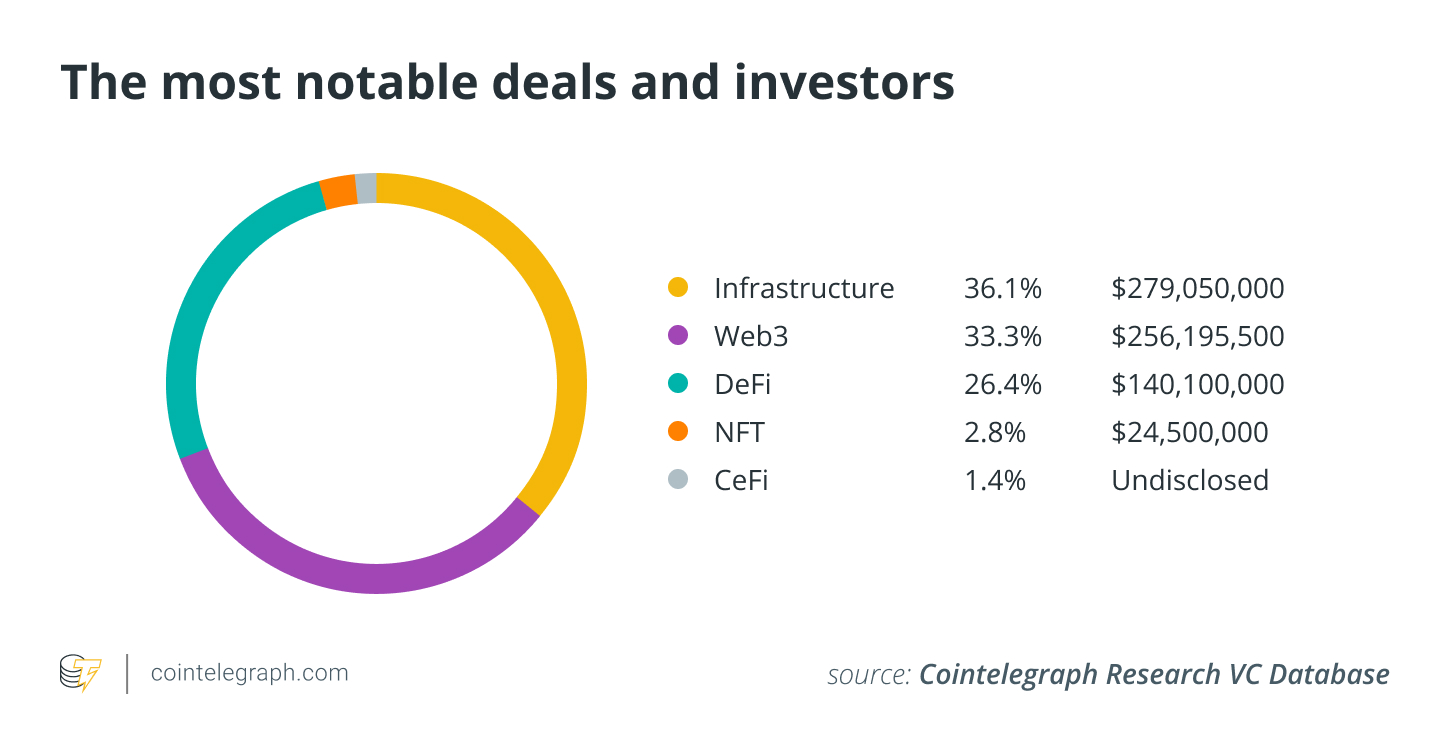

Infrastructure and Web3 stay ahead

Web3 has been one of the most active sectors measured by the number of deals, and July was no exception, with 26 individual deals raising $256.2 million. Conversely, infrastructure has brought in the most capital inflows recently and continued to do so, with $279 million over 24 deals in July. Decentralized finance followed up with $140.1 million invested across 19 deals, and centralized finance alongside with nonfungible tokens (NFTs) is yet again closing off the list.

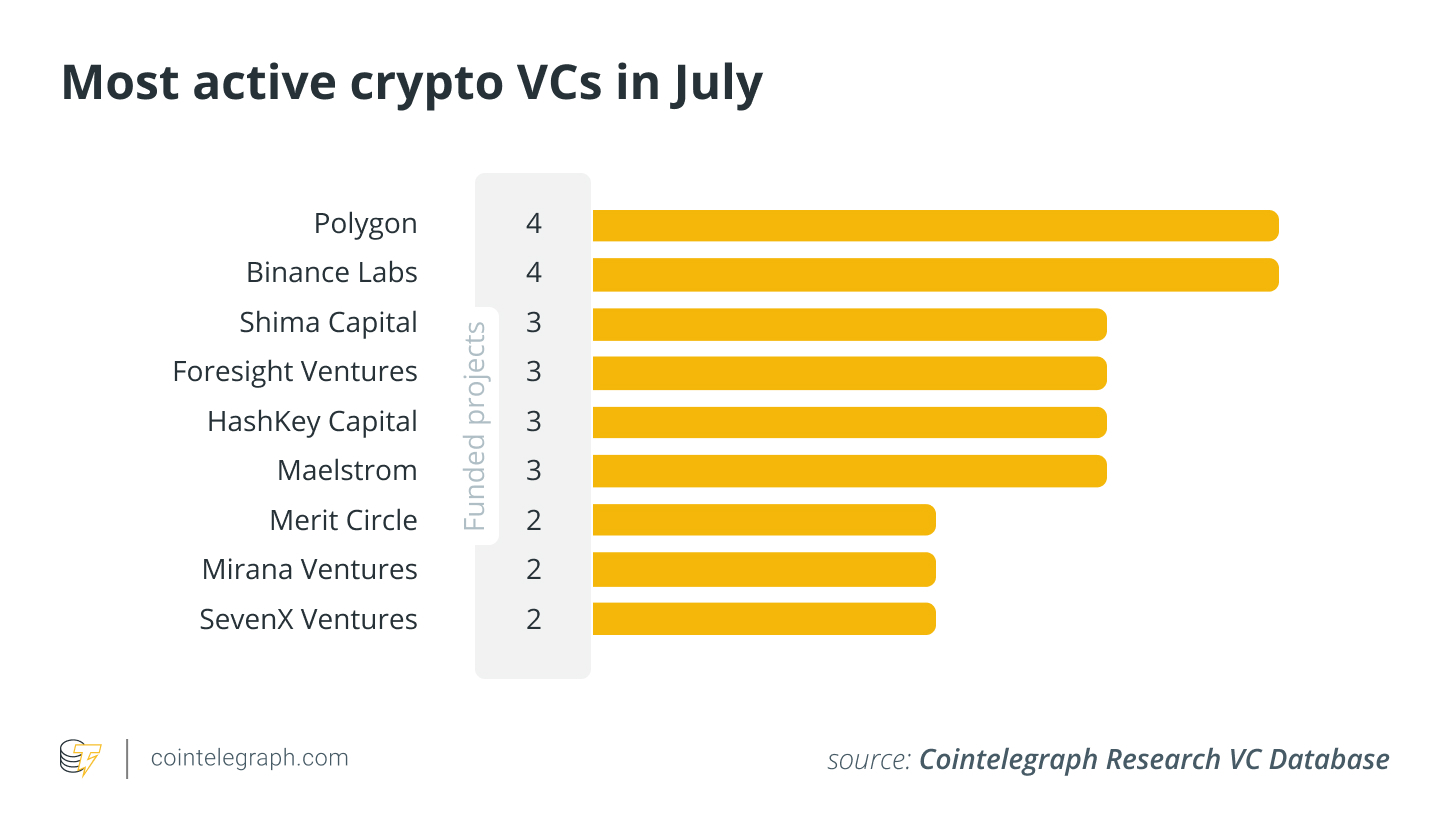

Polygon and Binance Labs participated in four rounds in the month of July. Interestingly, 0xBoost Finance, Aethir, Dappos and Delabs Games attracted investments from several prominent investment companies, including Polygon, Binance Labs, HashKey Capital and others.

However, none of these projects are among the top raisers. Web3 startup Zyber 365 is heading the list with a Series A round of $100 million. The round makes Zyber another fintech unicorn valued at over $1.2 billion, and the funds are intended to fuel global expansion.

Infrastructure solution provider Flashbots, which primarily focuses on reducing the negative impact of maximal extractable value on the Ethereum blockchain, managed to close a Series B round of $60 million from Sanctor Capital, HashKey, Animoca and others. Meanwhile, artificial intelligence (AI) metaverse startup Futureverse managed to close a $54-million Series A round from 10T Holdings and Ripple. Futureverse is a combination of 11 startups from various spheres ranging from blockchain and AI to NFTs and gaming, and aims to expand the company’s ecosystem.

The upward trend hasn’t continued in July, resulting in another month’s investments decreasing. Investor activity is lower, and although the positive sentiment about Bitcoin and Ether (ETH) ETFs approval in Europe and in the U.S. may change the VC landscape, it is unlikely that the blockchain industry will see a quick return to the steady upward trend.