Cboe Global Markets plans to launch new Bitcoin and Ether “Continuous Futures” on Dec. 15, offering long-term, perpetual-style exposure to both assets on its futures exchange.

According to a Monday announcement from the company, the contracts come with a 10-year term and a daily cash adjustment meant to mirror the economics of perpetual futures, removing the need to roll expiring positions.

Futures are standardized contracts that let traders buy or sell an asset at a set price on a future date, often used for hedging or speculation.

Cboe says the structure is intended to offer the same tools investors rely on in traditional futures markets, including capital efficiency, volatility hedging, tactical trading and the ability to take short exposure.

The contracts will be cleared through Cboe Clear US to reduce counterparty risk, with margin rules aligned to Commodity Futures Trading Commission (CFTC) standards and potential cross-margining with existing Cboe Futures Exchange (CFE) crypto futures. Pending regulatory approval, they will will trade 23 hours a day, five days a week.

Cboe Global Markets is a US exchange operator that runs equities and derivatives marketplaces across several regions, including North America and Europe. The company announced plans to roll out its “continuous futures” product for Bitcoin and Ether in September.

Related: Rare Bitcoin futures signal could catch traders off-guard: Is a bottom forming?

The crypto futures market

While US regulators have long blocked exchanges from listing crypto futures products, their stance has shifted under President Donald Trump’s administration, creating room for new crypto-derivatives offerings.

On April 21, the CFTC requested public feedback on the potential benefits and risks of perpetual derivatives, seeking input on how these products function, how they might be used in trading and clearing, and any implications for market integrity and customer protection.

In March, Bitnomial crypto exchange announced the launch of the first CFTC-regulated XRP futures in the US, and in July, Coinbase announced a plan to launch nano-sized Bitcoin and Ether perpetual contracts.

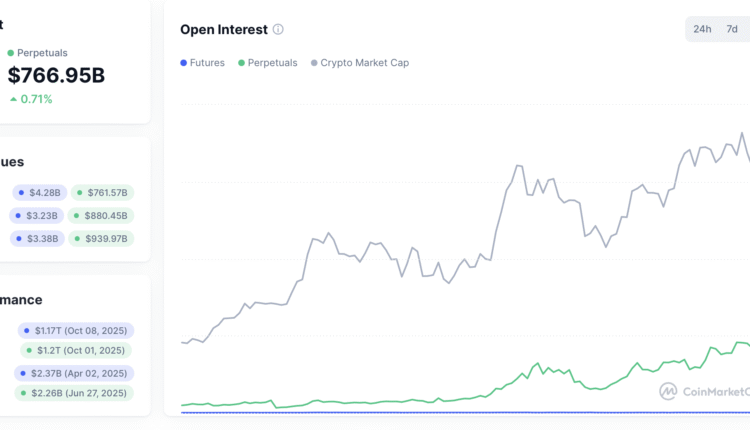

The crypto futures market is enormous. On Monday, open interest on perpetuals in the crypto market was about $767 billion, according CoinMarketCap data.

Magazine: Good luck suing crypto exchanges, market makers over the flash crash