Our weekly roundup of news from East Asia curates the industry’s most important developments.

3AC creditors strike back

On Sept. 29, Su Zhu, co-founder of defunct Singaporean hedge fund Three Arrows Capital (3AC) — which prior to its collapse last June managed more than $10 billion in digital assets — was apprehended at Singapore’s Changi International Airport while attempting to flee the country following the issuance of a committal order.

Just days prior to his arrest, Singaporean courts issued an arrest warrant for Zhu after his “deliberate failure to comply with a court order obtained which, in essence, compelled him to cooperate with the liquidator’s investigations and account for his activities as one of the founders of 3AC and its former investment manager.” Zhu, a Singaporean national, was sentenced to four months in prison for the breach.

Teneo, the appointed liquidator for 3AC, said in an email statement that creditors would “seek to engage with him on matters relating to 3AC, focusing on the recovery of assets that are either the property of 3AC or that have been acquired using 3AC’s funds” during his time in prison.

“The liquidators will pursue all opportunities to ensure Mr. Zhu complies in full with the court order made against him for provision of information and documents relating to 3AC and its former investment manager during the course of his imprisonment and thereafter,” Teneo wrote.

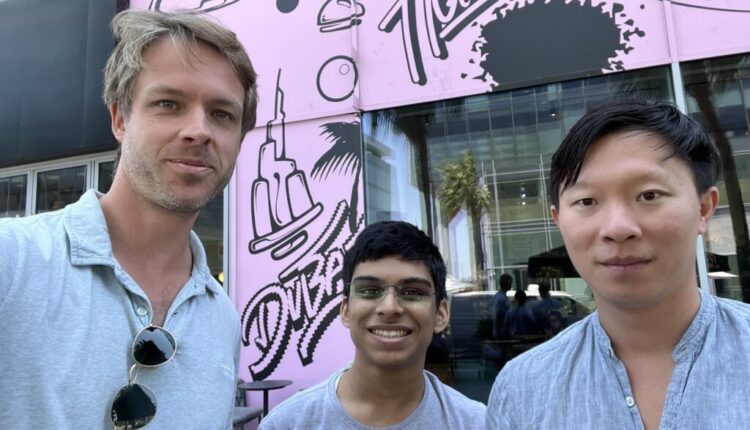

The filing revealed that Kyle Livingston Davies, 3AC’s co-founder and a naturalized Singaporean citizen, was also sentenced to four months imprisonment for contempt of court. However, his current whereabouts remain unknown. Cointelegraph previously reported that Davies had fled to Dubai earlier this year and opened a restaurant there.

Recently, the Monetary Authority of Singapore barred both Zhu and Davies from conducting enterprise investment activity in the city-state for nine years due to regulatory violations, such as exceeding 3AC’s statutory assets under management limit.

In July 2022, 3AC filed for bankruptcy after a series of failed leveraged trades on the Terra ecosystem left the hedge fund emptied of assets and left creditors with over $3.5 billion in claims. The event caused a chain reaction that led to the bankruptcy of 3AC’s counterparties, such as Celsius, Voyager and FTX. Prior to the “counterattack,” 3AC creditors had suffered a humiliating setback where over one year of bankruptcy proceedings were halted by a U.S. judge due to a clerical error.

At one point in the last year, Davies publicly boasted that there were “no pending lawsuits or regulatory action against him.” After the collapse of 3AC, both Zhu and Davies embarked on alternative entrepreneurial ventures. Aside from Davies’ restaurant, Zhu’s $36 million luxury Yarwood Homestead in Singapore, purchased just months before 3AC’s collapse, had been converted into an eco-farm. Local media writes:

“Based on the principles of ecological design and agroecology, the company transformed the garden into a farmland, an ecosystem that includes agriculture and aquaculture, producing local vegetables, herbs, fruits, fish, chickens and ducks.”

The farm is owned by Su Zhu’s wife, Evelyn Tan, through her company Abundunt Cities. “Yarwood Homestead is open to curious gardeners, citizen scientists, and the community on an invitation-only basis. We also run a private dining experience to help us test recipes for native edibles through our Native Edibles R&D Kitchen,” an excerpt from its website reads.

A second wave

When it rains, it pours.

In January, Zhu and Davies’ novel exchange OPNX — a platform based in Hong Kong for trading bankruptcy claims on fallen crypto companies such as 3AC and FTX — was spearheaded into development after soliciting $25 million from various investors. The platform launched in April with just $13.64 in trading volume on its debut. By June, the firm claimed it had reached nearly $50 million in daily trading volume.

However, holders of OPNX did not appear to have enjoyed news of Zhu’s arrest and Davies’ indictment. On the day of the announcement, the Open Exchange Token fell nearly 60% in a single day to $0.01. The token has lost 79% of its value in the past month and has a fully diluted market capitalization of just $77 million, compared with over $300 million in June.

Read also

In July, OPNX announced that it had onboarded tokenized claims of FTX and Celsius. Per design, claims would be converted into collateral in the form of OPNX’s native reborn OX (reOX) tokens or oUSD, its credit currency. Users could then trade crypto futures using reOX as collateral.

However, the firm’s claims dashboard remains dysfunctional at the time of publication. Leslie Lamb, OPNX’s CEO, had tried to distance the firm from Davies and Zhu, claiming that they are “no longer involved in [its] operations.” In August, all three executives were fined the equivalent of $2.7 million by Dubai’s Virtual Asset Regulatory Authority for running OPNX as an unlicensed exchange in the Emirate.

Prior to Zhu’s arrest, 3AC Ventures, a venture capital fund created by the duo in June, appeared to be doing quite well. Its investments have since expanded to a project called “Gamerlan” since its initial investment in Raise. “3AC Ventures is focused on superior risk-adjusted returns without leverage,” its creators proclaimed.

Regardless, creditors have made it clear that their priority is in “recovering the assets of 3AC and maximising returns for its creditors,” which could also include former 3AC assets that are used to create new entities. Teneo has since recovered several nonfungible tokens owned by 3AC and auctioned them via Sotheby’s, netting a total of $13.4 million. The proceedings are still ongoing.

Subscribe

The most engaging reads in blockchain. Delivered once a

week.

Zhiyuan Sun

Zhiyuan Sun is a journalist at Cointelegraph focusing on technology-related news. He has several years of experience writing for major financial media outlets such as The Motley Fool, Nasdaq.com and Seeking Alpha.