Opinion by: Robert Schmitt, founder and co-CEO at Cork

DeFi has entered its institutional phase. As large investors dip their toes into crypto ETFs and digital asset treasuries (DATs), the ecosystem is gradually evolving into an institutional-grade financial system in its own right, with the introduction of new financial instruments and digital counterparts of well-established ones.

DeFi’s current growth exposes mounting risks that could lead to trust roadblocks. For institutions to confidently onboard, the ecosystem must implement stronger risk guardrails and resilient infrastructure.

It’s worth exploring the main areas where risk is concentrated, how TradFi handles similar challenges, and the guardrails DeFi needs to safely scale institutional participation.

Breaking down DeFi’s biggest risk

Let’s start with protocol risk. DeFi’s composability is both its strength and its Achilles heel. The interlinking of LSTs, lending markets and perpetuals increases systemic dependency. A single exploit can cascade across protocols.

Followed by reflexivity risk, consider how staking derivatives and looping strategies create positive feedback loops that magnify market swings. As prices rise, collateral expands and leverage increases.

When prices fall, however, liquidations accelerate in the same manner, without coordinated circuit breakers.

Lastly, duration risk as lending and staking markets mature may become increasingly critical, given the need for predictable access to liquidity. Institutions need to understand the types of duration risks present in the markets they participate in. Not many are aware that the advertised withdrawal timelines for many protocols actually depend on solver incentives, strategy cooldowns and validator queues.

The institutional supercycle

DeFi’s next challenge is not more yield or higher TVL. DeFi’s next challenge is building trust. To bring the next trillion in institutional capital onchain, the ecosystem needs standardized risk guardrails and a new discipline around risk management.

The past two years of DeFi have been defined by institutional adoption. Regulated institutional products have gained massive TVL. The two most successful ETF launches in the last two years (out of 1,600 ETFs) were BlackRock’s iShares BTC and ETH ETFs. Net flows into ETH ETFs are going vertical.

Likewise, digital asset treasury companies attract capital from institutions. Recently, ETH DATs have absorbed roughly 2.5 percent of the ETH supply. The largest DAT, Bitmine Immersion, with Wall Street legend Tom Lee as chairperson, has accumulated over $9 billion of ETH in less than two months, driven by institutional demand for ETH exposure.

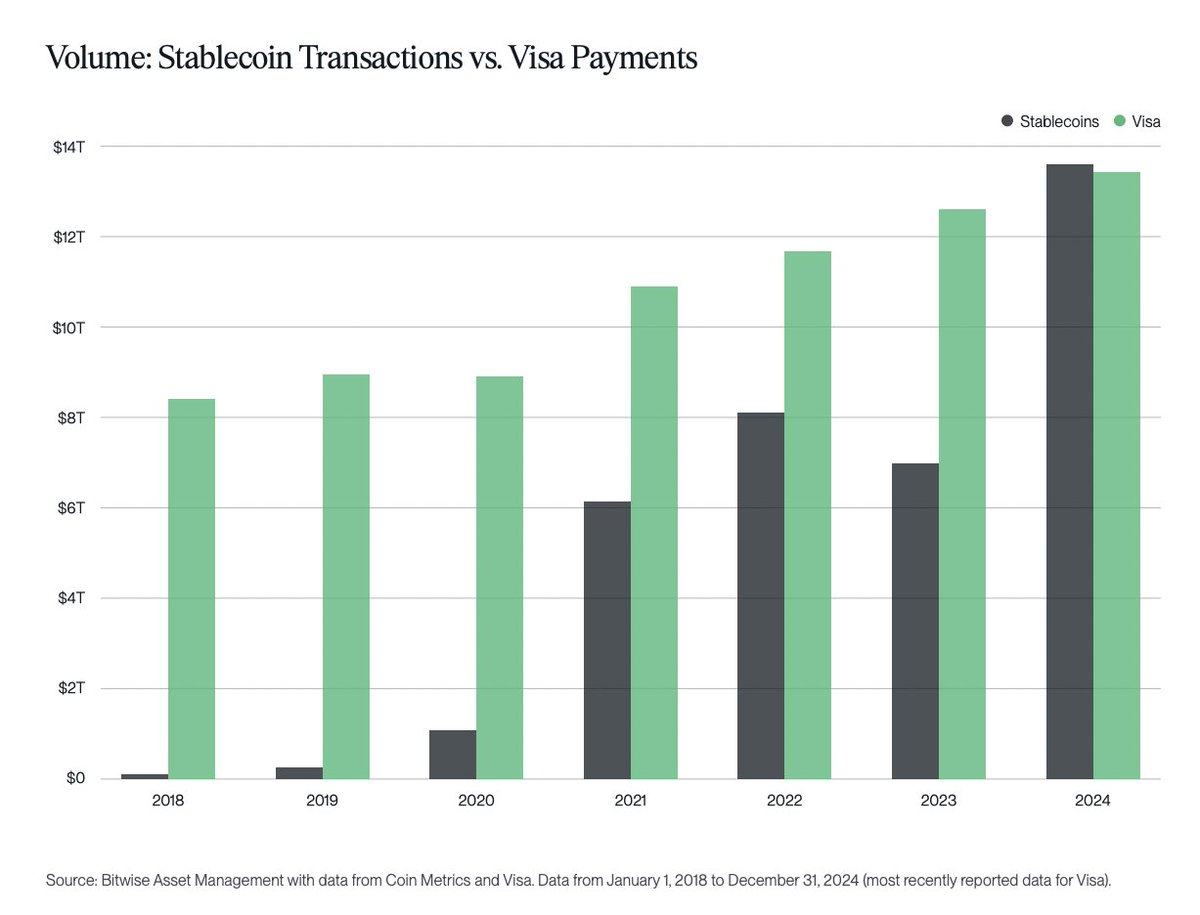

Stablecoins have become crypto’s product market fit amid new regulatory clarity. They now move nearly as much money each month as Visa, and their total value locked (TVL) across protocols approaches $300 billion.

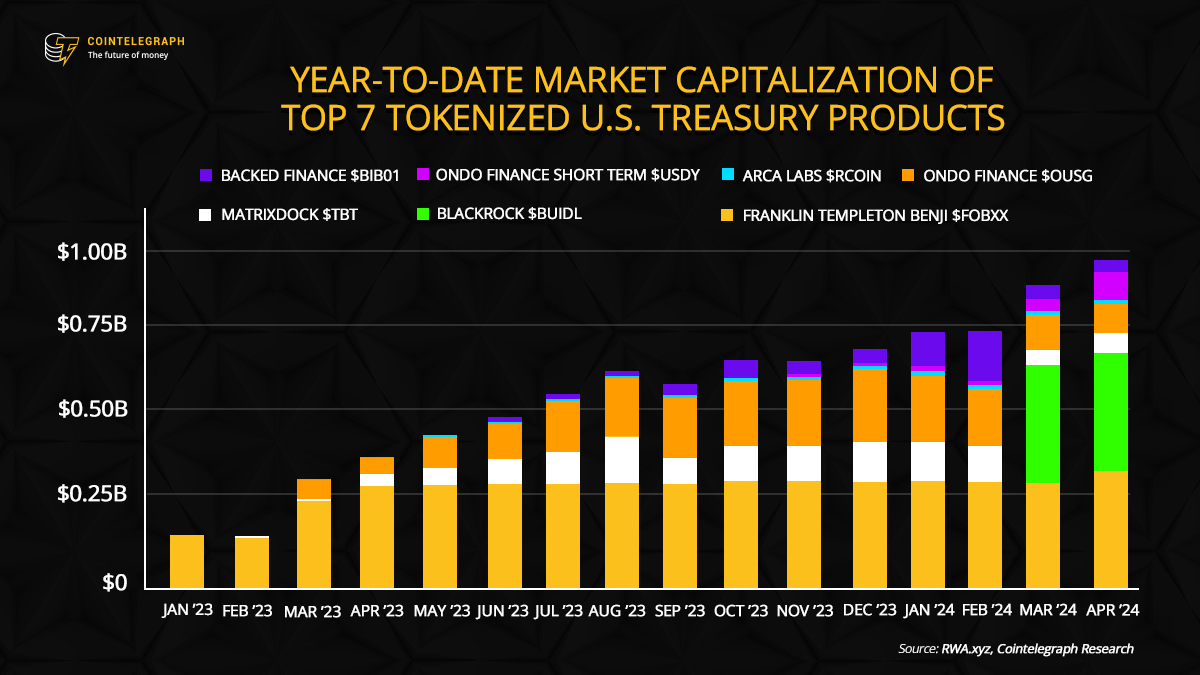

Similarly, the theme of tokenization has gained momentum, as evidenced by the rapid growth of tokenized Real World Assets (RWAs). Major institutions are tokenizing products, including Robinhood Europe, which is tokenizing its entire stock exchange, and BlackRock, which is tokenizing its T-bill BUIDL product.

Both stablecoins and RWA tokenization growth are driving the narrative that the future of the financial system will be on Ethereum. This, in turn, is driving the institutional adoption of ETFs and DATs.

The case for standardized risk management

According to a recent report by Paradigm, risk management comes in second as a cost category for institutional finance. This is because it is properly understood as an operational pillar that goes beyond checking a compliance checkbox. While traditional finance has not eliminated risk altogether, it has certainly systematized risk to the furthest extent.

Related: Not all RWA growth is real, and the industry knows it

In contrast, DeFi treats risk as a variable that varies from protocol to protocol. Each smart contract, vault and strategy defines and discloses risk differently — if at all. The result is idiosyncratic risk management and a lack of comparability across protocols.

TradFi has built shared frameworks, such as clearinghouses and rating agencies, as well as standardized disclosure norms, to address these types of risks and their real-world analogies. DeFi needs its own versions of those institutions: open, auditable and interoperable standards for quantifying and reporting on risk.

DeFi does not have to abandon experimentation to become a more mature ecosystem, but it could definitely benefit from formalizing it. The current risk framework established by DeFi protocols will not suffice moving forward.

If we are determined to break through the next wave of institutional adoption, however, we can follow the risk management principles established for financial instruments in traditional finance.

Opinion by: Robert Schmitt, founder and co-CEO at Cork.

This opinion article presents the contributor’s expert view and it may not reflect the views of Cointelegraph.com. This content has undergone editorial review to ensure clarity and relevance, Cointelegraph remains committed to transparent reporting and upholding the highest standards of journalism. Readers are encouraged to conduct their own research before taking any actions related to the company.

This opinion article presents the contributor’s expert view and it may not reflect the views of Cointelegraph.com. This content has undergone editorial review to ensure clarity and relevance, Cointelegraph remains committed to transparent reporting and upholding the highest standards of journalism. Readers are encouraged to conduct their own research before taking any actions related to the company.