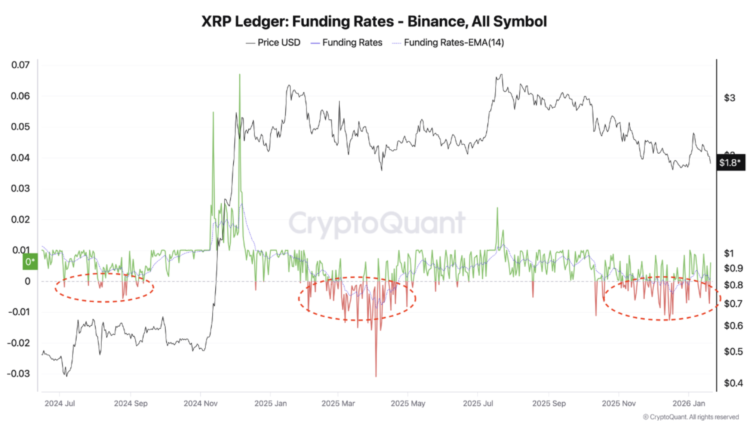

Similar XRP funding conditions preceded rebounds of roughly 50% in August and September 2024 and about 100% in April 2025.

XRP (XRP) funding rates on Binance have been mirroring the behavior seen ahead of sharp price rebounds since 2024.

Key takeaways:

Negative funding led to short squeezes since late 2024

Binance funding rates stayed mostly negative in the past two months. That meant more leveraged traders bet on XRP price falling, and that they had to pay to keep their short positions open.

The bearish consensus among derivatives traders formed after a roughly 50% decline in XRP spot prices from its multiyear high of $3.66, established in July 2025. However, according to on-chain analyst Darkfrost, this could hurt the bears in the coming weeks.

Related: These three XRP charts suggest a potential rally scenario toward $2.80

The analyst cited the period of persistent funding rates since 2024, each resulting in sharp price rebounds. That includes BTC’s 50% rise in August-September 2025 and over 100% gains in April-July 2025, as illustrated below.

“The accumulation of shorts does create short-term selling pressure, but it also builds latent buying pressure,” Darkfrost wrote, adding:

“If the price starts to rise, these positions could be liquidated, fueling the upward move.”

XRP bulls must restore the $2 level as support

As of January, XRP had rebounded modestly after testing the lower trendline of its year-long sideways channel trend, aligning with the $1.80-2.00 support area.

It was the same zone that served as the launchpad for a 100% rally to $3.66 in April 2025.

Meanwhile, the $2 level remains a key psychological line for XRP in the short to medium term.

In an earlier analysis, Glassnode found that each retest of the $2 area since early 2025 coincided with roughly $500 million to $1.2 billion in weekly realized losses, suggesting many holders used those moves to exit and cut their losses rather than add exposure.

From a technical standpoint, XRP bears are looking to pull the price toward its 200-week exponential moving average (200-week EMA blue wave) at around $1.40 if it fails to reclaim its 50-week EMA (red wave) at $2.22 as support.

The “latent-buying-pressure” thesis by Darkfrost will weaken materially if XRP price decisively loses the $1.80–$2.00 support zone.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.