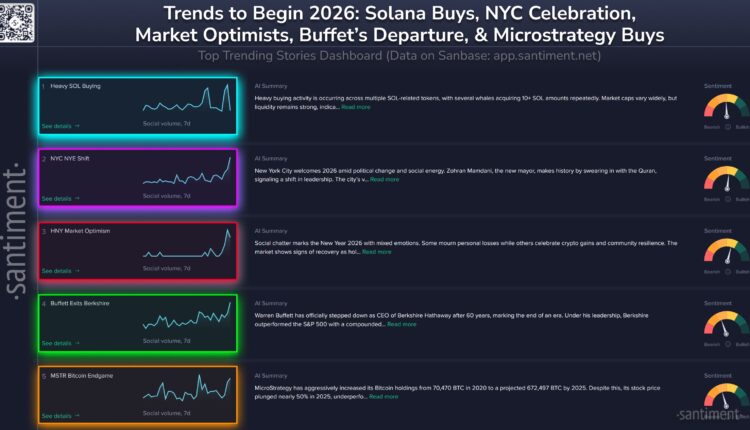

Cryptocurrency markets kicked off 2026 with a focus on Solana, as Santiment data showed discussion regarding whale accumulation of SOL-related tokens as the top trend on Thursday.

Santiment said multiple SOL-linked assets have seen repeated purchases of 10 or more Solana (SOL) by large wallets.

“Market caps vary widely, but liquidity remains strong, indicating sustained interest from large holders,” Santiment said in a Thursday post sharing five trending topics.

The market trend tracker’s “behavioral heuristic” scores for these assets hovered around 70%, indicating moderate but steady confidence among investors. Despite Solana losing about 46% of its value in the past three months, the data suggests increasing whale accumulation in anticipation of a price rebound, according to Santiment.

Related: AI Models Predict Bitcoin, Ether and Altcoin Prices for 2026

Other key trends at the start of 2026

The second trending topic was New York City entering 2026 against a backdrop of political change, as newly elected mayor Zohran Mamdani made history by taking his oath of office on the Quran.

Another widely discussed topic was the ongoing debate surrounding Strategy’s Bitcoin (BTC) accumulation, which continues to divide investors between those viewing it as long-term conviction and those concerned about balance-sheet risk after a volatile 2025.

Traditional finance has also entered the conversation. Bitcoin skeptic Warren Buffett’s official exit from Berkshire Hathaway after six decades has renewed discussions around legacy investment philosophies and their intersection with digital assets, particularly amid reports that the company’s new leadership may hold a more favorable view of Bitcoin.

Related: Strategy in 2026: Can its Bitcoin-first model hold up?

ETFs, stablecoins to accelerate crypto adoption in 2026

Elsewhere in the industry, discussions about tokenization and crypto’s convergence with traditional finance are gaining steam.

Momentum from clearer regulation is expected to build further in 2026 and accelerate adoption, according to Coinbase head of investment research David Duong. In a year-end post, Duong said 2025 laid the groundwork by expanding regulated access to crypto and pushing digital assets deeper into the financial infrastructure.

Duong said that spot ETFs, corporate crypto treasuries, the rise of stablecoins and tokenized assets are increasingly part of mainstream financial workflows.

He added that these trends are likely to compound next year as ETF approval timelines shorten, stablecoins gain a larger role in delivery-versus-payment systems and tokenized collateral becomes more widely accepted in traditional transactions.

Magazine: 2026 is the year of pragmatic privacy in crypto — Canton, Zcash and more