Ethereum (ETH) has experienced renewed accumulation from large whales over the past few days, despite the price being compressed under $3,000. However, recent onchain and futures data indicate growing pressure for a potential breakout.

Key takeaways:

-

Large whales added over $2 billion worth of ETH in recent days despite muted price action.

-

Exchange supply is tightening, and 70% of global ETH derivatives positions are net long.

Whale accumulation dominates recent ETH flows

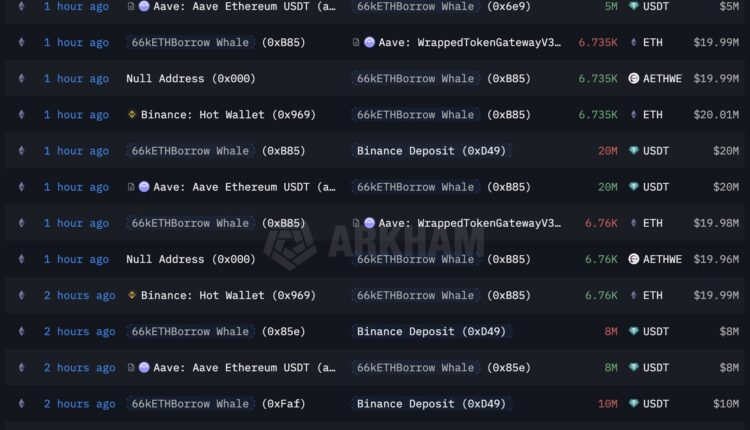

Data resource Lookonchain noted that the “66k ETH Borrow Whale” added another 40,975 ETH ($121 million) over the past day, bringing the total purchases to 569,247 ETH ($1.69 billion) since Nov. 4.

Likewise, treasury accumulation has also accelerated. Tom Lee’s Bitmine acquired an additional 67,886 ETH ($201 million) in the past 24 hours and roughly $302 million over the past week.

Related: Ether analysts see ‘upward breakout’ as ETH price returns to $3K

Bitmine currently holds 4.06 million ETH, valued at $12.4 billion, representing about 3.37% of the total ETH supply.

Earlier, Cointelegraph reported that Trend Research purchased 46,379 ETH this week, lifting its holdings to roughly 580,000 ETH, surpassing most publicly tracked Ether treasuries. Only SharpLink Gaming and BitMine held more ETH.

Related: How Wall Street is using Ethereum without talking about Ethereum

Crypto analyst CW said that Ether whales currently hold ETH at cost bases close to prevailing market prices. CW added,

“As a result, the unrealized profit of $ETH whales is almost non-existent. They did not take profits in this cycle, and they are further increasing their holdings.”

ETH leverage exposure expands as supply tightens

Derivatives positioning adds another layer to ETH’s setup. Data from Hyblock Capital shows that about 70% of global net Ether positions on Binance are currently long over the past 30 days.

Meanwhile, ETH’s Estimated Leverage Ratio (ELR) reached an all-time high of 0.611 last week, indicating that traders are deploying increasing leverage relative to exchange reserves.

At the same time, onchain supply dynamics are moving in the opposite direction. Ether’s exchange supply ratio on Binance has dropped to 0.032, its lowest level since September 2024, indicating a shrinking pool of ETH available for selling.

From a technical standpoint, ETH remains compressed below the $3,000 and 200-period exponential moving average (200-EMA).

While this structure favors downside continuation, the divergence between tightening exchange supply and elevated leverage suggests that any decisive move could expand upwards once lower liquidity is swept around the swing lows at $2,600.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.