Digital asset treasuries will soon evolve beyond being “static vaults” for well-known cryptocurrencies and instead look to offer tokenized real-world assets, stablecoins and other assets that generate yield, according to crypto executives.

“The next phase of Web3 treasuries is about turning balance sheets into active networks that can stake, restake, lend, or tokenize capital under transparent, auditable conditions,” said Maja Vujinovic, the CEO of Ether (ETH) treasury company FG Nexus.

“The lines between a treasury and a protocol balance sheet are already blurring, and the firms that treat treasuries as productive, onchain ecosystems will be the ones that outperform.”

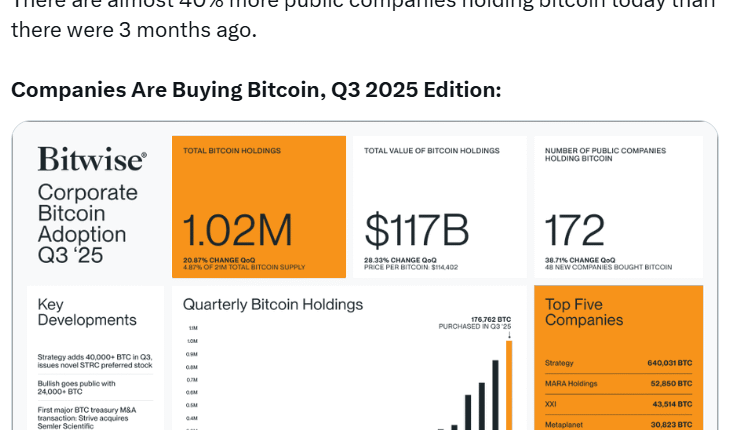

The number of crypto treasuries has exploded this year, with an October report from asset manager Bitwise tracking 48 new instances of Bitcoin (BTC) being added to balance sheets in the third quarter.

Sandro Gonzalez, the co-founder of the Cardano-based project KWARXS, which links real-world solar infrastructure to the blockchain, said DATs will shift from speculative storage to strategic allocation.

“The next wave of adoption will include assets that tie blockchain participation to tangible output — such as renewable energy, supply chain assets, or carbon reduction mechanisms,” Gonzalez said.

“Over time, this will redefine how organizations think about balance sheets in the Web3 era — not just as stores of value, but as instruments for measurable, sustainable contribution to real economic activity,” he added.

Treasury firms will expand past cryptocurrencies

Brian Huang, the CEO of crypto investment platform Glider, said the decision of what can be adopted as a treasury asset is only limited by what is onchain.

“On-chain stocks and tokenized RWAs are the most obvious things to include in a treasury. Gold has skyrocketed this year, and it’s easier to hold tokenized gold than physical gold,” he said.

“Additionally, there are illiquid investments, such as NFTs and tokenized real estate. The thing to emphasize here is that the limitation is just what assets are onchain.”

John Hallahan, the director of business solutions at digital asset custody platform Fireblocks, predicted there will be more adoption of stablecoins, tokenized money market funds and tokenized US Treasurys.

“The next wave of digital assets being adopted for treasury purposes will be cash equivalent instruments such as stablecoins and tokenized money market funds,” he said.

“Longer term, we will see many more types of securities issued onchain, such as treasuries, corporate debt and physical assets such as real estate. For the more unique assets, such as real estate, they may be represented by non-fungible tokens.”

Digital media and entertainment company GameSquare Holdings announced in July that it had bought an NFT of a Cowboy Ape in a $5.15 million “strategic investment,” along with Ether.

Nicolai Søndergaard, a research analyst at the onchain analytics platform Nansen, said decisions around which assets are adopted in the future will likely be dictated by legislation and the risk appetite of companies.

“While I can’t say with certainty, I do not think it will be unexpected that we will see companies add treasury assets not before considered possible as treasury assets,” he said.

Factors affecting what assets will be adopted

However, Marcin Kazmierczak, the co-founder of blockchain oracle provider RedStone, said any tokenized asset can theoretically be held as a treasury reserve asset; what will eventually be adopted comes down to accounting, regulation, and fiduciary duty.

“A Bitcoin or Ethereum holding is straightforward for auditors and boards. An NFT requires an appraisal methodology that most frameworks don’t have standardized answers for. More importantly, treasuries are supposed to hold assets that maintain value and can be liquidated if needed.”

“That’s easier with Bitcoin than with a speculative NFT that might have limited buyers. The limit exists at the point where liquidity dries up and the board can’t justify holding it to shareholders or regulators,” he added.

Related: Are struggling firms using crypto reserves as a PR lifeline?

Long-term, Kazmierczak predicts that beyond the top five cryptocurrencies, adoption will likely stay marginal for traditional companies because the risk-adjusted returns aren’t enough to justify the move for most boards.

“We might see tokenized real assets gain traction if legal frameworks clarify, but pure Web3 assets beyond the major cryptocurrencies will remain experimental and confined to crypto-native companies or venture firms specifically positioned for that risk,” he said.

“What might accelerate is tokenized real-world assets like yield-bearing bonds or commodities. Those have inherent value propositions that don’t depend on market sentiment.”

Magazine: How do the world’s major religions view Bitcoin and cryptocurrency?