Today in crypto, a Wall Street veteran predicts that institutional interest in Bitcoin allocations will grow by the end of the year, a crypto exec says stablecoins will lose tickers in the future. Meanwhile, top Web3 white hats are earning millions uncovering DeFi flaws.

TradFi to ramp up Bitcoin allocations by year-end, Wall Street veteran tips

Wall Street veteran and macro analyst Jordi Visser is forecasting that US financial institutions are set to ramp up their Bitcoin allocations before the year is out.

“Between now and the end of the year, the allocations for Bitcoin for the next year from the traditional finance world are going to be increased,” Visser told Anthony Pompliano during an interview published to YouTube on Saturday.

“I think Bitcoin’s allocation number will go higher across portfolios,” Visser said. “That is going to happen,” he emphasized.

Visser predicts that traditional financial institutions will bolster their Bitcoin allocations in the final quarter of this year in preparation for next year, the same quarter that market participants are debating over whether Bitcoin’s price will peak for the cycle or not.

US dollar stablecoins won’t have tickers in the future, only generic “USD”

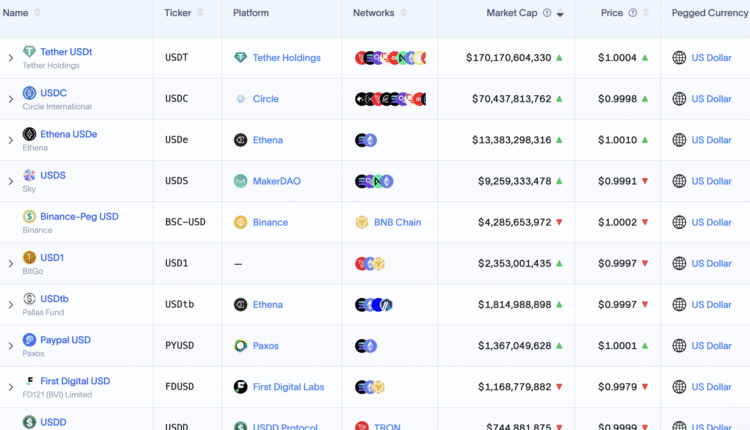

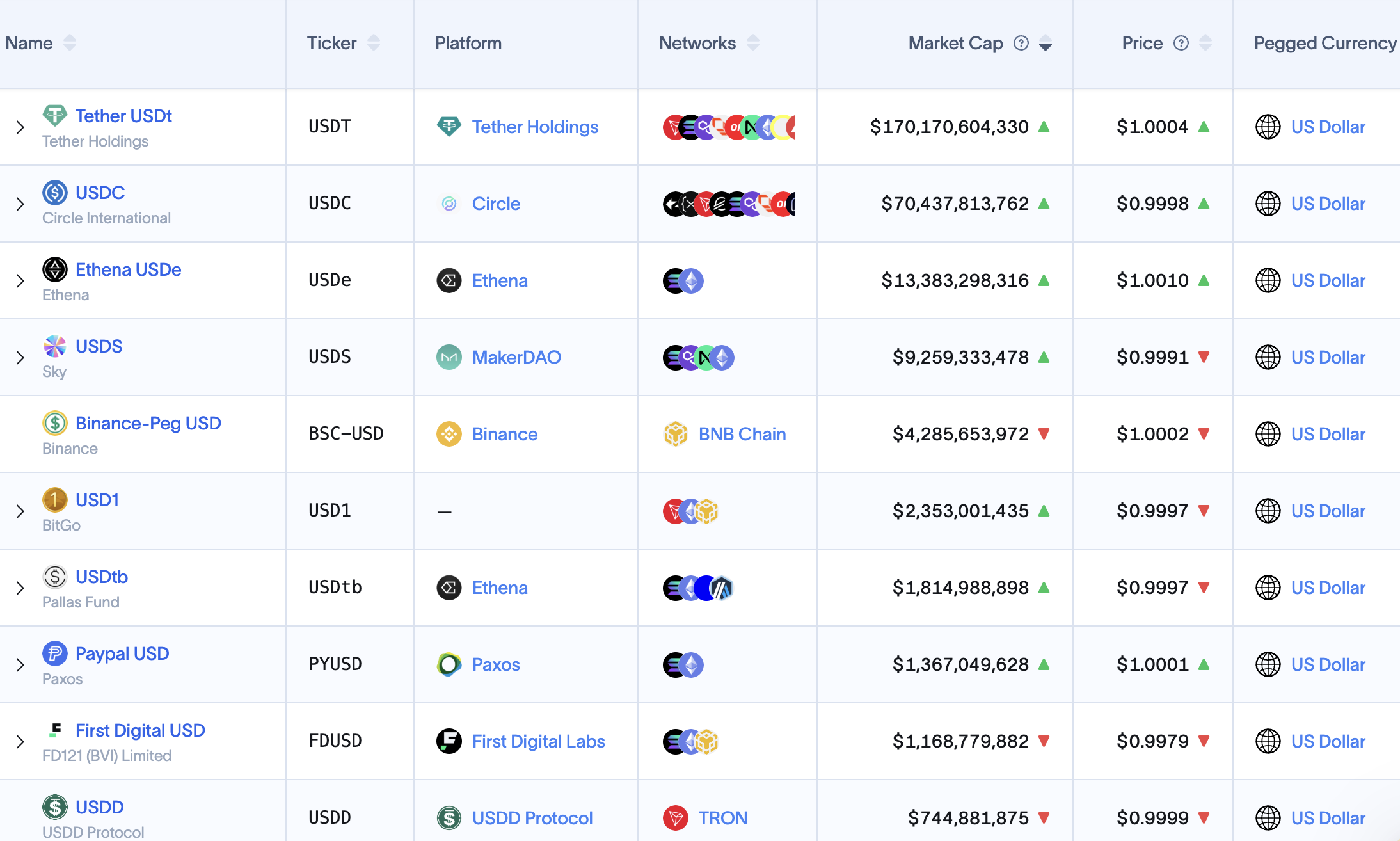

Stablecoins pegged to the US dollar won’t have individual price tickers in the future, according to Mert Mumtaz, CEO of remote procedure call (RPC) node provider Helius.

Mumtaz said that stablecoins have become commoditized, meaning that there is little difference between them from a user perspective.

He predicted that exchanges will eventually drop the tickers altogether, choosing to swap stablecoins through backend infrastructure that users never see. He wrote:

“The eventual endgame is that you don’t see the ticker at all. The apps will just display ‘USD’ instead of USDC, USDT, or USDX, and they will swap everything in the backend via a standardized interface.”

Mumtaz’s comments follow the Hyperliquid stablecoin (USDH) bidding war and come amid a period of rapid growth for the sector, as the stablecoin market cap surpasses $280 billion.

Web3 white hats earn millions, crushing $300K traditional cybersecurity jobs

Top white hats hunting vulnerabilities across decentralized protocols in Web3 are earning millions, dwarfing the $300,000 salary ceiling in traditional cybersecurity roles.

“Our leaderboard shows researchers earning millions per year, compared to typical cybersecurity salaries of $150-300k,” Mitchell Amador, co-founder and CEO of bug bounty platform Immunefi, told Cointelegraph.

In crypto, “white hats” refers to ethical hackers paid to disclose vulnerabilities in decentralized finance (DeFi) protocols. Unlike salaried corporate roles, these researchers choose their targets, set their own hours and earn based on the impact of what they find.

So far, Immunefi has facilitated more than $120 million in payouts across thousands of reports. Thirty researchers have already become millionaires.