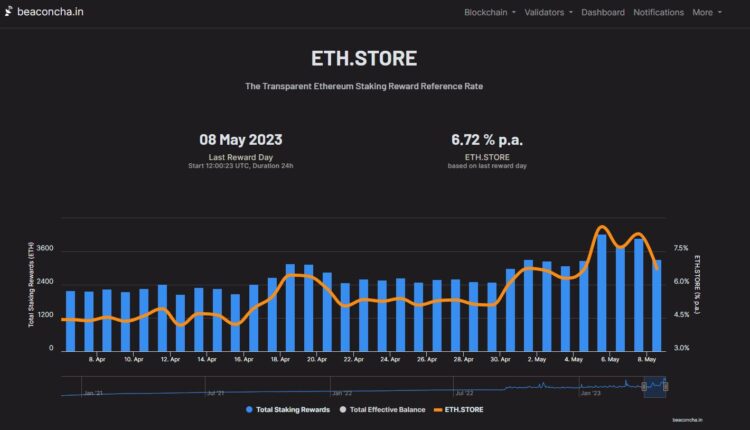

Validators earned $46 million in the first week of May due to an increase in the staking rewards rate, which is a metric for validators’ annualized yield. According to data, validators earned 24,997 Ether (ETH) in the week, representing a 40% increase over the previous week’s income of $33 million, when 18,339 ETH were distributed as rewards.

The recent trading craze of a new memecoin called Pepe (PEPE) is the reason behind the increased rewards for validators. In the past week, the average fees on the Ethereum network have exceeded 100 gwei, marking the highest level since May 2022. As gas fees increase, end users pay over $30 per swap, resulting in higher fee income for validators from processing transactions and the regular validator rewards.

Beaconcha.in states that the present staking rate signifies the anticipated annualized return for validators. In order to engage in the network’s consensus procedure, validators on Ethereum are mandated to stake a minimum of 32 ETH, valued at roughly $58,000.

There are two types of rewards identified by ETH Store, a company that measures reward rates: consensus rewards for proposing and attesting blocks, and transaction fees for processing transactions on the Ethereum network.

Related: Worth it? Trader spends $120K on gas buying $155K worth of a memecoin

Since Ethereum’s network moved to a proof-of-stake consensus mechanism with the Merge in 2022, and following the recent Shapella upgrade enabling validator withdrawals for the first time, ETH staking has attained significant interest from institutions.

Magazine: Joe Lubin: The truth about ETH founders split and ‘Crypto Google’