The $11 billion Bitcoin whale who correctly predicted the $19 billion October market crash is once again betting on the price appreciation of the top cryptocurrencies, signaling a potential market recovery.

After cashing out $330 million in Ether (ETH), the whale opened three leveraged long positions worth a cumulative $748 million, betting on the price increase of Bitcoin (BTC), Ether, and Solana (SOL).

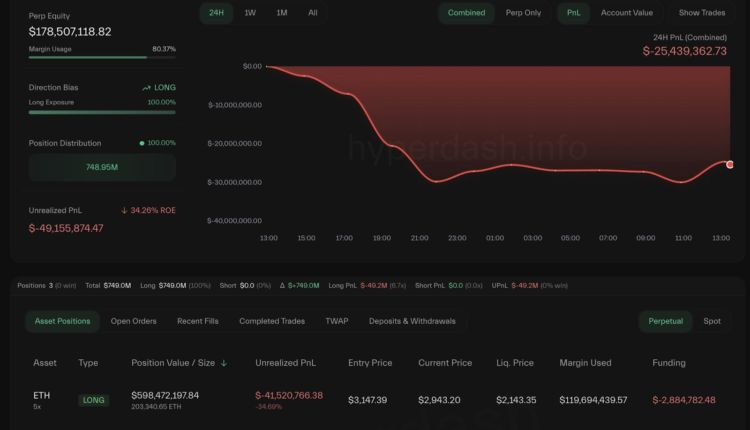

The largest is an ETH long position worth $598 million, opened at $3,147, which faces liquidation if Ether’s price falls below $2,143, according to blockchain data platform Lookonchain’s Tuesday X post.

Based on their recent transaction patterns, the savvy whale is positioning for a short-term rally in the three leading cryptocurrencies as he continues to run his leveraged positions despite facing approximately $49 million in unrealized losses.

Related: BitMine locks up $1B in Ether as big corporates stake ETH for yield

The $11 billion Bitcoin whale emerged in August and rotated around $5 billion worth of BTC into ETH, briefly surpassing the second-largest corporate treasury firm, Sharplink, in terms of total ETH holdings, Cointelegraph reported on Sept. 1.

The Bitcoin whale started rotating their funds into Ether on Aug. 21 when they sold $2.59 billion of BTC for a $2.2 billion spot ETH and a $577 million Ether perpetual long position, inspiring nine “massive” whale addresses to acquire a cumulative $456 million worth of ETH within a day, shortly after the whale’s initial rotation.

Related: These three altcoins came back from the dead in 2025

Whales increase ETH buying, but smart money traders are still short for $122 million

Other crypto whales have also been increasing their spot Ether acquisitions, signaling more confidence from large investors, a key cohort for driving price momentum.

Crypto whales increased their Ether acquisition rate by 1.6-fold during the past week, amassing $7.43 million spot ETH across 19 wallets, according to crypto intelligence platform Nansen.

However, the industry’s most successful traders by returns, tracked as “smart money” traders on Nansen, continue betting on Ether’s price decline.

Smart money traders were net short on Ether for a cumulative $121 million, with $6.5 million in long positions added during the past 24 hours, according to Nansen.

However, smart traders were also net short on Bitcoin for a cumulative $192 million and on Solana for $74 million.

Magazine: Solana vs Ethereum ETFs, Facebook’s influence on Bitwise — Hunter Horsley